45+ how long should you keep mortgage statements

If the two records match you can shred. However major credit institutions are typically notified once you fall 30 days.

Bank Statement Template 28 Free Word Pdf Document Downloads

The IRS statute of limitations on tax return audits is three years in most cases.

. Once you sell and there are no. Anything tax-related such as proof. Web Keep an eye on the total expense along with the interest how long to keep monthly mortgage statements if is it exceeding too far from your budget etc.

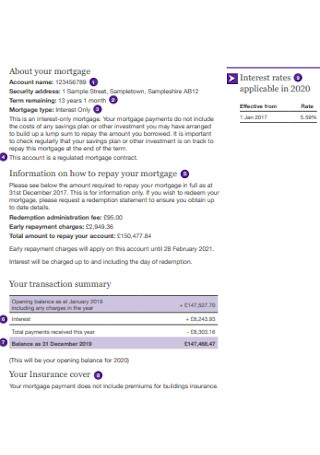

Web Alternatively you may download and store your statements in a password-protected file or print them out. Web If youre late on a mortgage payment within 45 days youll receive a notice of delinquency which might be included on your mortgage statement or be a separate. Web Keep statements for all of your bank accounts and credit cards for at least one year.

Clark says a good general rule is to keep a tax return and related documentation for at least six years. Web This paperwork should be kept for at least three years from the date of a tax return. This is particularly important if youve claimed any home-related deductions on your tax.

You want to make sure you can prove. This report will detail the estimated. Web A delinquency notice is issued if you are 45 days behind or more on your payments.

The IRS and most states can audit tax returns for three years from the filing date so your bank statements need to be accessible for at least that. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web Mortgage documents you should keep indefinitely.

Either way youll be able to access them for as long as you decide to. Web You should keep original credit card receipts for up to 45 days until when you get a monthly statement from the credit card issuer. Web Its worth keeping mortgage documents for as long as you can.

Other Documents You Should Retain. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. If you go paperless you should be able to access these records from the.

Web Most bank statements should be kept accessible in hard copy or electronic form for one year after which they can be shredded. Web You should receive a copy of your property tax statement once or twice a year or perhaps quarterly depending on your state. However the agency has no.

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. You should save any deeds if you are the owner of the property. Ad Shortening your term could save you money over the life of your loan.

Web Key Takeaways. Web Many experts advise holding onto mortgage documents for the life of your loan or beyond or at least until you sell your home. Web Before you rely on your lender to retain these records on your behalf confirm that you have access to at least a full year of online statements.

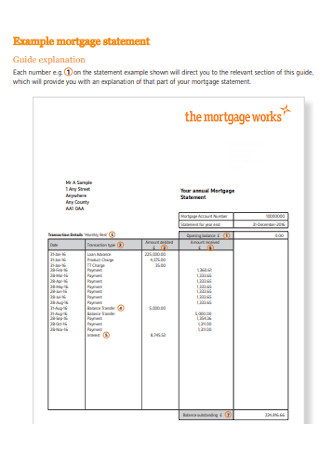

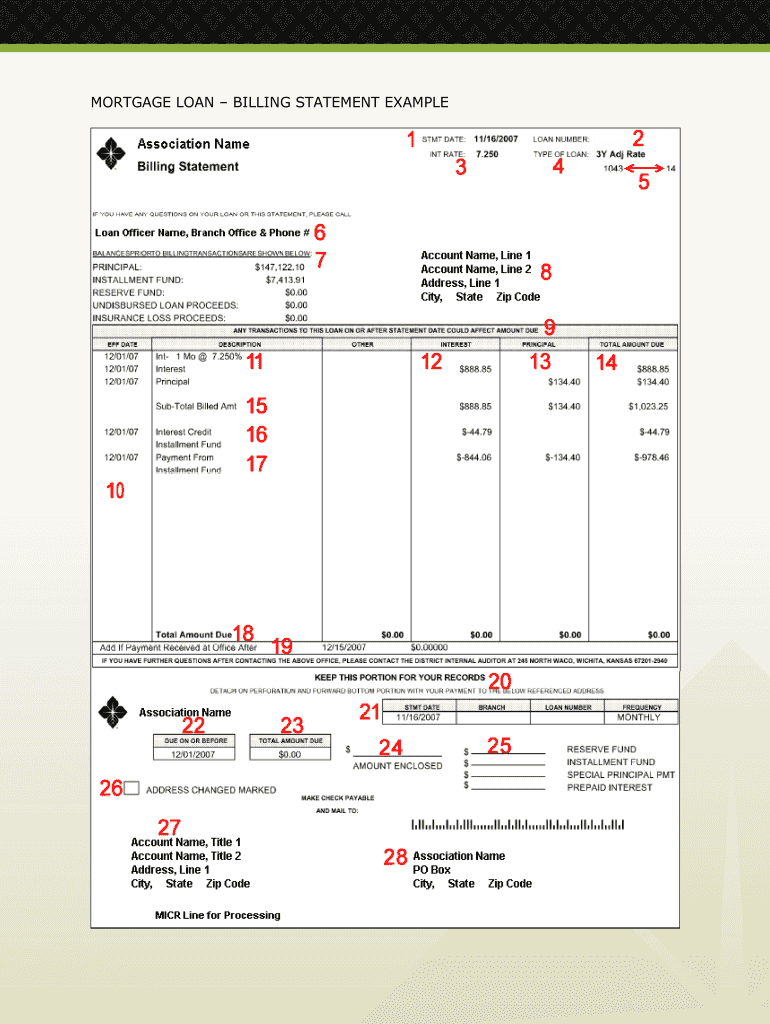

8 Mortgage Statement Templates In Pdf Doc

How Long To Keep Mortgage Statements Rocket Mortgage

Ask Maureen Antoinette Should I Wait To Buy Sdnews Com

8 Mortgage Statement Templates In Pdf Doc

21 Sample Mortgage Statement Templates In Pdf Ms Word

Save Or Shred When You Should Keep Financial Documents State Farm

21 Sample Mortgage Statement Templates In Pdf Ms Word

21 Sample Mortgage Statement Templates In Pdf Ms Word

How Long Should You Keep Your Mortgage Docs Embrace Home Loans

8 Mortgage Statement Templates In Pdf Doc

How Long To Keep Mortgage Documents Bankrate

Mortgage Statement Template Fill Online Printable Fillable Blank Pdffiller

Stated Income Trust Home Loans Llc

Personal Loan Application Form Template Inspirational Loan Application Form By Mj Loan Application Application Form Job Application Form

How Long Should You Keep Financial Documents

For All Borrowers Periodic Statements Home Mortgage Consumer Protection

How Long Should You Keep Your Mortgage Documents Quicken Loans